The (r)evolution of Digital Wallets

Written by George Agathangelou

In an earlier article regarding NFTs and Digital Identities we touched upon the subject of Digital Wallets and how our own data, content, and identity will be kept as NFTs stored in web3 digital wallets. These web3 wallets will be as imperative as emails are today for accessing almost everything. In this article we will expand our views on Digital Wallets, critical considerations, and what these might look like in the future.

Nowadays, it is more likely that you will download a wallet from an app store than go to a store and pick it out. The digital transformation era we are currently seeing has changed the way we work, play, and socialize. In turn, the digital wallet sector is one of the fastest-growing industries in the world with this trend showing no signs of slowing down soon. Wallets are evolving to be the place where we keep all our important documents. These may be bank account credentials to cloud service credentials such as music and video-on-demand streaming services, or even IRL (in real life) accommodation accounts such as Airbnb and Booking.com, the unique pieces that make up our everyday life will eventually become tokenized as NFTs and will be kept in digital wallets.

Digital wallets are replacing single-function digital banking and payment solutions, and AI-powered digital assistants are enabling further personalized services and automated processes. For example, Cleo AI (Artificial Intelligence) app can connect to your bank account to read transaction history and data to help you manage your finances and build back a better credit score (no pun intended). Cleo AI’s chatbot can integrate with Facebook Messenger, Amazon’s Alexa, and Google Home, supplying an interactive user experience through both text and voice, which some may find rather creepy. Creepy or not, virtual assistants are becoming more “human” and the technology is evolving to allow natural language processing and understanding of documents. However, we need to consider that privacy and security are paramount for the successful access to sensitive financial and biometric information for these AI assistants to function well.

Another important trend to note when it comes to digital wallets are wearables. These come in the form of smart watches, smart glasses, headsets, medical bands, and smart apparel, allowing us to interact with services and even allow us to pay and enjoy a cup of coffee after our morning run by the beach. Such devices have become increasingly popular and play a significant role in the consumer’s daily life as they offer a wide range of functionalities and wearing options. However, wearables also are a double-edged sword. The wearables technology is the most recent technology of IoT (Internet of Things) and deals with generating lots of human health data (Blood-Oxygen levels, step counters, GPS tracking etc.) on cloud. When such health information is stored, there is always an inherent rise of risk of getting sensitive data in the wrong hands. Users’ sensitive data might be lost, intercepted, or stolen. Authentication methods currently employed might fail under various circumstances.

Besides wearables, a developing number of companies are competing in market share for all things finance. The race combines a wide range of payments, banking, credit, investment, and insurance products within a single app, while others are enabling users to store important documents and access cards on their smartphones for everyday use. But how can these digital apps evolve to deliver on security, scale, and convenience?

Currently, the future of digital wallets is being shaped primarily by large Fintech companies like Venmo, MoneyLion, M1 Finance and Revolut, that offer mobile friendly platforms that most find easy to use. Tech giants such as PayPal and Apple are also trying to become the go-to money management apps in their efforts to use their networks, brand recognition and UX ability to gain traction amongst users. In Asia, the well-known examples are AliPay and WeChat apps that both started out as digital wallets, and then used their vast payments infrastructure to add more services. Nowadays, both apps may be used for a wide variety of everyday activities, from buying groceries and apparel to access to insurance products and stocks.

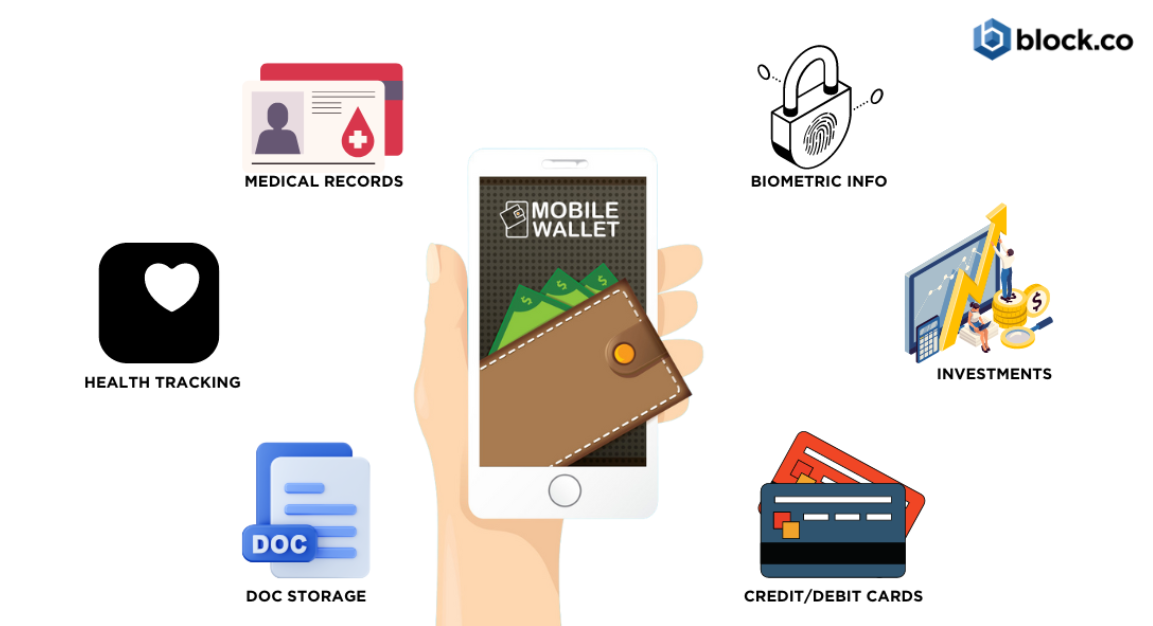

Mobile wallets are today essential to the way we are organizing existing financial accounts. The standard mobile wallet works as a “relatively” safe storage device for tokenized credit cards, debit cards and bank account information. As the fintech landscape is evolving, an increasing number of digital wallets are evolving beyond the single-function app approach. They include financial services such as loans, insurance, investments, and trading, essentially providing a one-stop shop (or app) for financial services, offering a connected ecosystem where users can manage their finances, savings, payments, budgets, and insurance, all from one app.

The response of governments and state actors to COVID-19 has accelerated the digital transformation in payments, identity verification and access control, and has speeded up the adoption of mobile and contactless alternatives in these areas. Between these lines, the payments sector has seen the highest adoption rate of mobile alternatives, with an increasing speculation that mobile wallets will broadly replace cash and plastic cards within the next decade, to the detriment of financial privacy. However, mobile wallets have the potential to transform more than just transactions, they can transform the way we manage our digital identity.

The evolution of mobile wallets, namely “Digital ID Wallets” are appearing as an all-in-one solution not only for payments but also for ID verification and access management. These ID wallets may store payment information together with other important documents such as passports, state IDs, Social Security numbers, medical records, keys to your house and office, as well as biometric information such as fingerprints and face scans. These will allow for seamless ID verification, payments, and access to services by automatically sharing user information related to user activities. For example, these digital ID wallets would confirm access to your company’s office after confirming your Social Security Number matching the SSN (Social Security Number) of employees of the company or supply passport information at an airport without having to wait for long queues on a busy day.

As these technologies gain traction, governments will be inclined to get on board either by creating their own digital ID wallets or by standing on the shoulders of tech giants. They will also have to provide a strong regulatory framework and policies in order to manage privacy and the risks associated with digital wallet IDs. However, history has shown that criminals preying on people’s personal information are rarely disincentivized by such rules and regulations. The many hacks on centralized points of failure with the most recent hack of the Revolut app compromising more than 50,000 customer accounts is just the tip of the iceberg.

Besides the security element, there is also the risk of these tech-giants being used for political purposes and censorship. In other cases, governments and tech giants collude to push their own agendas or to fight what they consider to be “misinformation”.

The clear solution would be to use a platform that is out of the control and reach of political campaigns, information and censorship. Enter public blockchains! The term censorship resistance is used to describe several key aspects of public blockchains.

When referring to the benefits of blockchain, the list includes security, decentralization, immutability, transparency and censorship resistance. Talk on censorship often includes issues around free speech, the freedom of the press, and the fight against misinformation (and expression). In the context of public blockchains like Bitcoin and Ethereum, the meaning is often similar.

Instead of referring to the suppression of information or the fight on misinformation, censorship in the context of blockchains refers to the suppression of financial activity or transactions. Censorship resistance, then, is fundamentally tied to who can use the blockchain and for which purpose, as well as who can append information contained on a blockchain.

Censorship resistance describes the ability of anyone able to use protocols such as Bitcoin and Ethereum. Age, location or political affiliations have no context when accessing public blockchain networks. If you can access the internet and run the software, you can examine the open-source code, and create your own copy of the code.

Censorship resistance may also be used in a way that describes the effects of a blockchain’s decentralization. These decentralized networks do not require intermediaries to verify correctness of information on transactions. They are trustless in the way that they rely on math, cryptography and peer-to-peer P2P networks. This mitigates anyone’s ability to prevent users from sending transactions within these networks, despite government attempts to impose sanctions.

Secondly, censorship resistance also refers to the immutability of the blockchain, transactions are final once they have been executed and confirmed. These public blockchain networks are designed to keep the accuracy of information and do not allow anyone to rewrite history, for any reason. Every block on the blockchain is cryptographically linked to its earlier block, creating a chain of blocks, a blockchain. This means, that anyone wanting to change information on one block, would be forced to change the entire blockchain. Although it is possible, this 51% attack would cost billions of dollars for a single entity to gain control of most of the computing power on Bitcoin’s network. But in that case, the nodes would simply take notice of the event and would fork the blockchain to nullify the attack, causing the attacker a tremendous economic hit without any success in censoring information or transactions.

Blockchain wallets may be a physical device, or even an application that enables individuals to store and transact digital assets such as cryptocurrencies and NFTs. The crucial elements of this kind of wallet are the private key, public key and address. Your wallet holds your private key that only you should know, no one can touch your account without that private key, with the advantages being everything that we mentioned on blockchains earlier (censorship resistance, immutability etc.), and the disadvantages (compared to centralized custodial wallets) being that no one can help you if you lose your private key, or no entity being able to guarantee your assets like an Investors Compensation Fund scheme. This implies that people need to take personal responsibility over their digital assets and wealth. They cannot trust third parties to do that for them, although people in Cyprus and Lebanon can already testify that they cannot be any trust towards any financial institution after losing their lifelong savings over the last decade.

Depending on which camp you belong, you might refer to custodial (hosted) wallets in contrast to non-custodial or un-hosted wallets, OR to freedom and independent wallets in contrast to third party wallets. “Not your keys, not your coins” is a common mantra in the Bitcoin space, and in many cases where KYC (Know Your Customer) information is required, this also means “Not your keys, not your coins and not your personal data!”.

If implemented well in combination with technologies that supply the highest levels of security without a single point of failure, these universal digital identity wallets may have the potential to significantly reduce fraud, censorship and bureaucratic processes. There is clearly a need for a trustless system without intermediaries to safeguard the myriad items that make up our digital identity. And with these technologies in combination with the digital wallets we described earlier, it seems quite likely (if not inevitable) that the unique pieces that make of our everyday life will eventually become tokenized as NFTs and will be kept in digital wallets.

If your brand is ready to take the step into web 3.0 and NFT marketing, to optimize engagement with your audience in innovative ways, then click the button below to get your Free Trial, a limited number of Free NFTs, and a Free Consultation call from our team!

To get more information about Block.co’s services, please contact us directly or email at enquiries@block.co.

Tel +357 70007828

We regularly post educational materials on our social media, follow us to stay up to date about the latest blockchain and NFT news.