Bitcoin’s Security and Hash Rate Explained

As the Bitcoin hash rate reaches new all-time highs, there’s never been a better time to discuss blockchain security and its relation to the hashing power and the Proof of Work (PoW) that feed the network. The Bitcoin system is based on a form of decentralized trust, heavily relying on cryptography. This makes its blockchain highly secure and able to be used for financial transactions and other operations requiring a trustless ledger.

Far from popular belief, cryptography dates back thousands of years ago. The same root of the word encryption — crypt — comes from the Greek word ‘kryptos’, meaning hidden or secret. Indeed, humans have always wanted to keep some information private. The Assyrians, the Chinese, the Romans, and the Greeks, all tried over the centuries to conceal some information like trade deals or manufacturing secrets by using symbols or ciphers carved in stone or leather. In 1900 BC, Egyptians used hieroglyphics and experts often refer to them as the first example of cryptography.

Back to our days, Bitcoin uses cryptographic technologies such as:

- Cryptographic hash functions (i.e. SHA-256 and RIPEMD-160)

- Public Key Cryptography (i.e. ECDSA — the Elliptic Curve Digital Signature Algorithm)

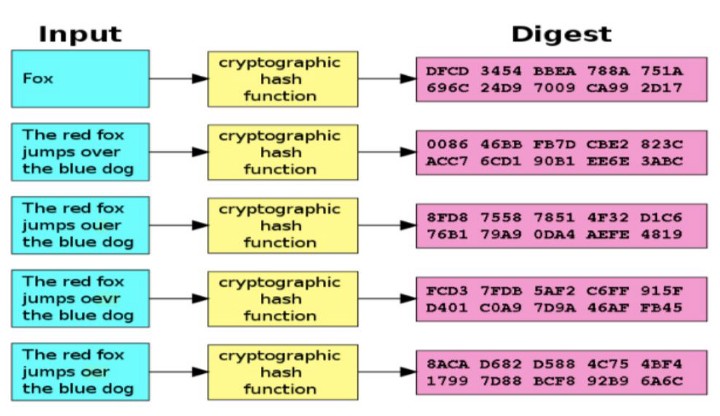

While Public Key Cryptography, bitcoin addresses, and digital signatures are used to provide ownership of bitcoins, the SHA-256 hash function is used to verify data and block integrity and to establish the chronological order of the blockchain. A cryptographic hash function is a mathematical function that verifies the integrity of data by transforming it into a unique unidentifiable code.

Here is a graphic example to make things more clear:

– Extract from the MOOC (Massive Open Online Course) in Digital Currencies at the University of Nicosia.

Furthermore, hash functions are used as part of the PoW algorithm, which is a prominent part of the Bitcoin mining algorithm and this is what is of more interest to understand the security of the network. Mining creates new bitcoins in each block, almost like a central bank printing new money and creates trust by ensuring that transactions are confirmed only when enough computational power is devoted to the block that contains them. More blocks mean more computation, which means more trust.

With PoW, miners compete against each other to complete transactions on the network and get rewarded. Basically, they need to solve a complicated mathematical puzzle and a possibility to easily prove the solution. The more hashing power, the higher the chance to resolve the puzzle and therefore perform the proof of work. In more simple words, bitcoins exist thanks to a peer-to-peer network that helps validate transactions in the ledger and provides enough trust to avoid that a third party is involved in the process. It also exists because miners give it life by resolving that computational puzzle, through the mining reward incentive they are receiving.

Think of it as a game. In order to get a reward (a validated block containing bitcoins), the miner needs to win the game by resolving a (computational) puzzle through hashing power (energy, feed, pulse). In the beginning, when Bitcoin was first launched, the network was small and clearly required little hashing power to resolve the puzzle. That is why a simple computer would have been enough to mine a bitcoin. Nowadays it has grown considerably that more hashing power (energy) is required to ‘win that game’, add transactions to a block and allow it to be verified and valid. With an automatically adjustable difficulty that allows a new block to be generated every 10 minutes, hashes allow Bitcoin to adapt over time and remain stable with a growing network. Hash rate, or hashing power, is the primary measure of a Bitcoin’s miner performance and the hash rate chart shows the uptrend over time currently indicating a rate of over 120,000 PH/s (120 EH/s).

BTC hash rate fell dramatically when the cryptocurrency reached 2018 low of $3234 on December 16th and went from October’s 58 terahash (or 58 TH/s, or 58 trillion hashing operations per second) to 34 TH/s on 13th December. For those into specific data and numbers, the current Bitcoin’s hash rate is pushing above 120 quintillions (120,000,000,000,000,000,000+) hash calculations per second, making Bitcoin’s PoW to be orders of magnitude higher than even the largest supercomputers, in terms of hash calculations per second. In December 2017, when bitcoin hit its all-time high of nearly $20K the network was still all but as strong as it is now since the hash rate back then was roughly 15 TH/s, while current figures show that it is 7 times higher.

As more miners join the network, the hash rate increases. A strong hash rate is indicative of a secure blockchain and makes it more difficult for bad actors to perform a 51% attack. A 51% attack may occur when miners or nodes get enough power to control the majority of mining (hashing) power and consequently manage most events in the network. They can monopolize generating new blocks and receive rewards since they are able to prevent other miners from completing blocks and they can manipulate and reverse transactions to allow double-spending.

It needs to be said that other than the hashing power and the cost of electricity, other factors must be in place for an attack to be effective. These go from the cost of the hardware and its maintenance used to mine the coins to the location where mining occurs and the costs required to cool down the hardware.

It is believed that such an attack on bitcoin would currently cost US$18,939,471,299.

In light of this, a 51% attack is not a profitable option therefore highly unlikely on the Bitcoin blockchain. As of now, the Bitcoin blockchain has never suffered one. We hope we have provided some indication of how difficult it is to even attempt to tamper with the Bitcoin network.

The University of Nicosia and Block.co have been taking advantage of Bitcoin’s immutability guarantees as early as 2014 to safely anchor proof of issuance for certificates and diplomas.

If your brand is ready to take the step into web 3.0 and NFT marketing, to optimize engagement with your audience in innovative ways, then click the button below to get your Free Trial, a limited number of Free NFTs, and a Free Consultation call from our team!

For more info, contact Block.co directly or email at enquiries@block.co.

Tel +357 70007828

Get the latest from Block.co, like and follow us on social media: